is there real estate tax in florida

No distinct tax on sole proprietorships and partnerships. The exact tax rate youll end up paying depends on several factors.

Palm Coast Flagler County Florida Flagler County Property Taxes Vs The Rest Of Florida

The Florida real estate homestead tax exemption is by far the most popular and common way to reduce your property tax bill.

. Tangible personal property taxes. There are some laws that limit the taxes due on owner-occupied homes in Florida. The average Florida homeowner pays 1752 each year in real property taxes although that amount varies between counties.

Additionally a legal Florida resident can still owe estate taxes in other states. Real estate property taxes. Florida property owners have to pay property taxes each year based on the value of their property.

The median property tax in Florida is 177300 per year for a home worth the median value of 18240000. Further for all other types of transfers in Miami-Dade County there. Businesses owned by single individuals are sole proprietorships.

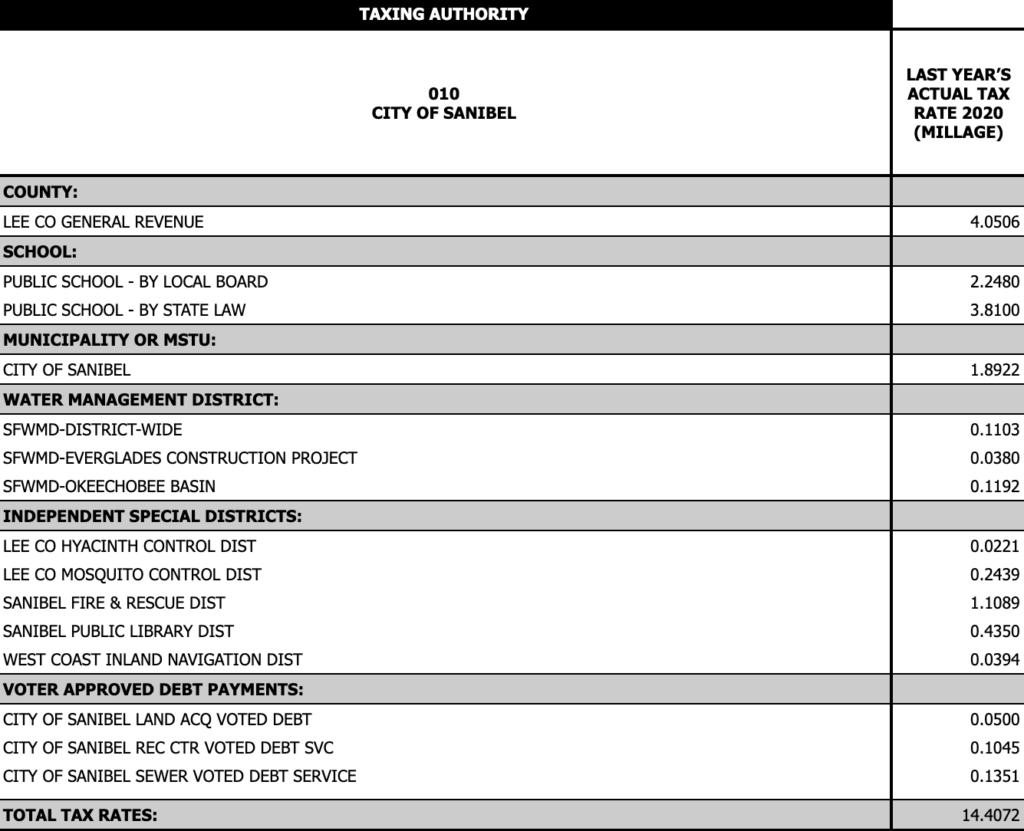

There are two types of ad valorem property taxes in Florida which are Real Estate Property and Tangible Personal Property. Florida real property tax rates are implemented in millage. These tax statements are mailed out on or before.

In Florida there are two caps on how much property owners can increase their homestead SOH by. For example the Save Our Homes assessment limitation caps increases in assessments for property taxes. In the year after the property receives the homestead.

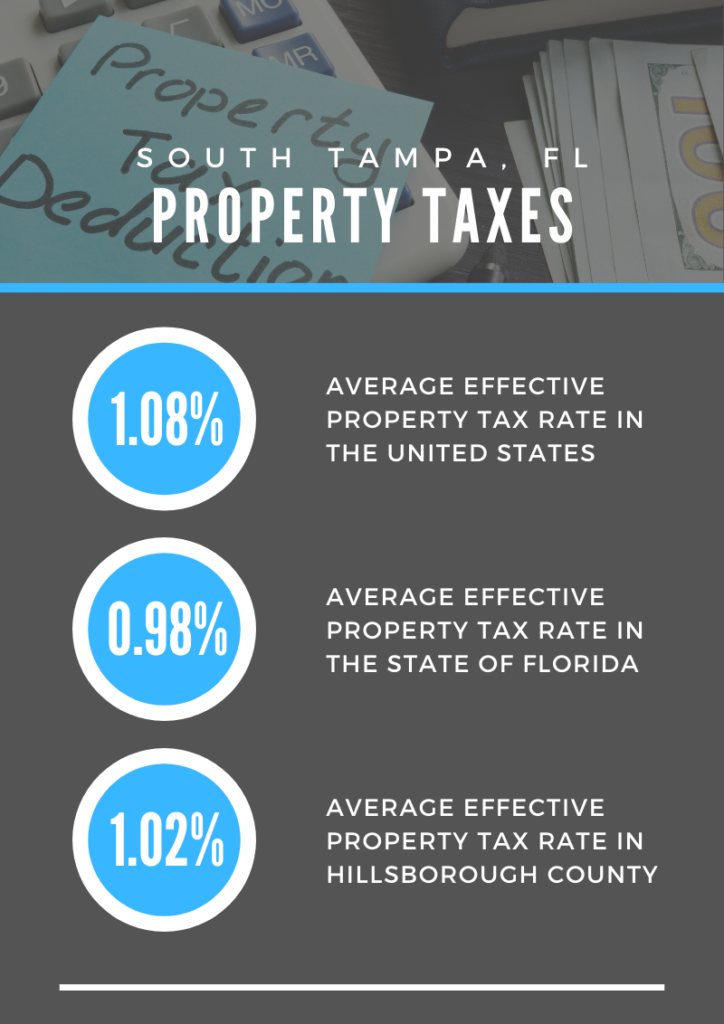

Also shows where you can save. Currently there is no estate tax in Florida. The average Florida mill rate is 113 meaning that the value of your property will be multiplied by this factor to arrive at your annual property tax bill.

Provides an inside look at how real estate taxes work in Florida. What is the Florida property tax or real estate tax. Average mill rate is 107 so.

Real estate property taxes are collected annually and may be paid online only 2021 taxes until May 31 2022. It is worth noting that there is no state property tax in Florida. There is no Florida capital gains tax but you still have to pay federal taxes if you sell a home in the state.

History of the Florida Estate Tax. Owners pay the tax to their local municipality which is also the entity responsible for setting the tax rate. If payment is brought in person the payment must be received by May 31 2022.

You will likely be taxed by. Prior to the change in 2004 federal law allowed a credit. Property taxes apply to both.

Provides an inside look at how real estate taxes work in Florida. In Miami-Dade County however the stamp tax rate is 60 per 100 or a rate of 06 for transfers of single-family residences. New Ownership Triggers Property Reassessment In Florida.

This would often be because of owning a house other real estate business or other assets in that. The state abolished its estate tax in 2004. Since Floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after January 1 2005.

There are two types of ad valorem or property taxes collected by the Lee County Tax Collectors office. According to section 193155 FS property appraisers must assess homestead property at just value as of January 1 of each tax year. Since floridas estate tax was based solely on the federal credit estate tax was no longer due on estates of decedents that died on or after january 1 2005.

In Florida there are currently no specific business or. Counties in Florida collect an average of 097 of a propertys assesed fair. This property tax exemption is not limited to the elderly or.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Tax Rates To Celebrate Gulfshore Business

Real Estate Archives Florida Estate Planning Florida Probate Florida Real Estate Florida Bankruptcy And Tax Attorneys

Property Taxes In South Tampa Fl Your South Tampa Home

Property Tax Calculator Estimator For Real Estate And Homes

Real Estate Property Tax Constitutional Tax Collector

What Is Florida County Real Estate Tax Property Tax

How Are Property Taxes Handled At A Closing In Florida

Are There Any States With No Property Tax In 2022 Free Investor Guide

What Is Florida County Tangible Personal Property Tax

Calculating State Transfer Taxes In Florida Florida Real Estate Exam Math Tutorial Youtube

Tax Benefits Of Investing In Florida Real Estate Florida Property Management Sales

10 Highest And Lowest Florida County Property Taxes Florida For Boomers

Florida Real Estate Taxes What You Need To Know

What Is A Florida County Real Property Trim Notice

Florida Ok S Property Tax Breaks Following Surfside Collapse

Tangible Personal Property State Tangible Personal Property Taxes

Florida Tax Liens Deeds Real Estate Investing Book How To Start Finance Your Real Estate Small Business Mahoney Brian 9781537452272 Amazon Com Books